By Michael Ge

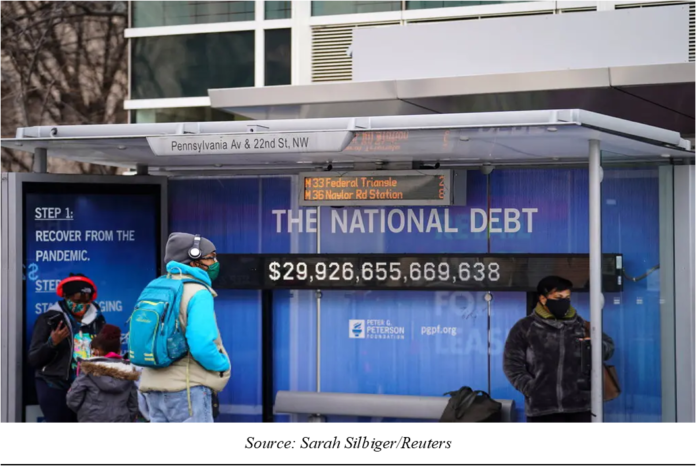

On February 1, the Treasury Department announced that the total amount of national debt exceeded $30 trillion. This is dangerous news for the financial health of the United States. In order to fully pay off this debt, the government would have to spend $10 trillion more than the entire economy. This is happening all while there has been record inflation that is causing prices to greatly increase among us.

The great increase in the national debt was caused by increased borrowing to pay for economic stimuli to support people and businesses going through economic hardship caused by the COVID-19 pandemic. Before the pandemic, the national debt was projected to reach $30 trillion in 2025.

Although many worry about the high debt, others argue that there is no need to worry. Low interest rates have allowed for federal investments. Furthermore, the Federal Reserve is expected to raise interest rates starting next month. The federal budget deficit has also decreased as the economy is improving and there are less stimulus payments going out.

It is unlikely that any of this debt will be paid off in the near future. The federal government has not run a budget surplus since the end of the Clinton administration. The tax cuts caused by the Trump administration have only exacerbated an existing issue, and the national debt is only projected to increase in the years to come. The national debt will be a persistent issue among us for a long time.