By Darshini Dayanidhi

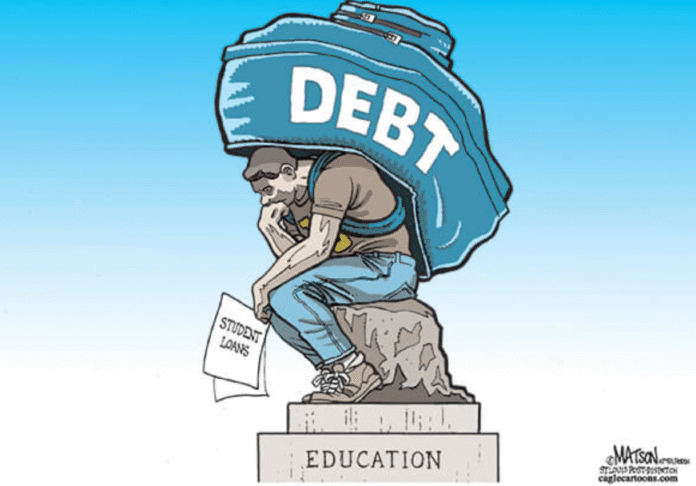

As high school students, we often hear that a college education is a key to success—yet it increasingly comes at a high price. For many, that price is paid in student loans that linger long after graduation. While some graduates manage their debt with ease, others find it to be a significant barrier that influences many aspects of their lives. While the benefits of a degree are undeniable, the growing reality of debt forces many graduates to rethink their goals and make tough choices.

One of the first and most immediate impacts of college debt is how it steers students’ career decisions. Graduates often feel compelled to choose high-paying jobs over their ideal career paths, even if it means compromising on passion. A student who dreams of working in the arts or social services, for instance, may feel pressured to pursue a more financially stable career in fields like technology or finance, just to handle monthly loan payments. This need to prioritize financial security over personal interest creates a challenging reality, as many young people find themselves working jobs they might not enjoy just to stay afloat.

Many East seniors have shared their own experiences when it comes to money and college. Armita Rohani says, “The cost of a college tuition is probably one of the only reasons I’m considering going back to Canada. If I go to Toronto, I’ll graduate debt free, but as someone who wants to live in the U.S., it’d be harder for me to get a job, or citizenship. Since I am considered an international student in american colleges, my tuition is well above $80,000 USD, each year. It’s a tough decision.” When asked about Junior Jessica Dennehy’s intended college major, she states, “It’s going to be pre-med, engineering, or some sort of money-maker. My parents, along with the debt, will kill me otherwise.”

College debt also affects students’ ability to make major life choices, like purchasing a home or starting a family. With large portions of their income going toward loan payments, graduates are often forced to put these milestones on hold. Buying a house, for example, might seem impossible when a person is already dealing with a massive debt load. Similarly, the idea of raising a family can feel daunting for someone who is already struggling with financial obligations. This delay in achieving personal milestones can be frustrating, leaving young adults feeling like they are constantly playing catch-up.

Additionally, college debt can stand in the way of financial independence. Student loans tie graduates to strict monthly payments, which can make it hard to save for emergencies or even consider investments that might build wealth over time. For many, the weight of debt affects everything from daily expenses to long-term goals, leaving less room to make independent choices and build a secure financial future. It can feel as if, instead of working toward personal freedom, graduates are working solely to escape from debt.

College debt may open doors to valuable opportunities, but it also closes others, affecting how students can shape their lives after graduation. As we think about our own futures, it’s essential to weigh not only the rewards of a college education but also the potential trade-offs.