By Seth Gellman

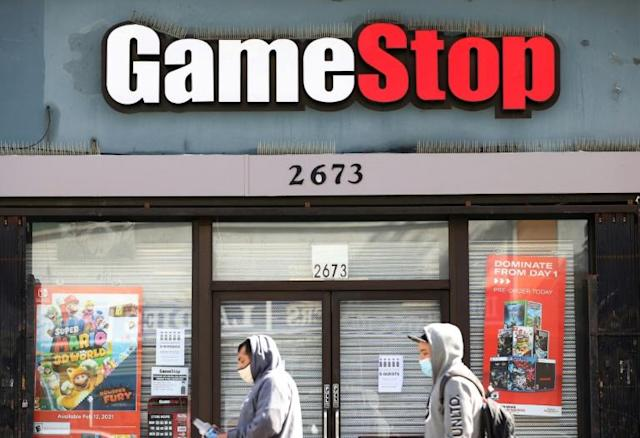

In January, GameStop’s share price dramatically increased as a result of investors on the forum WallStreetBets. Panic ensued, and there were calls for more regulation as retail investors demanded to be given back access to the market after Robinhood stopped trading the stock temporarily.

On Monday, the Securities and Exchange Commission released its report, outlining what happened without recommending any specific changes. The report was highly anticipated because there were expectations that the commission chairman, Gary Gensler, would recommend vast structural changes to the American Stock market.

However, there were some concerns highlighted in the report. Specifically, payments for order flow, where a brokerage firm receives compensation for selling the right to execute retail investors trades to a bigger trading institution, was highlighted as potentially creating conflicts of interest for retail brokers in the 45-page report.

Retail investors have challenged payments for order flow in the past, specifically in a class action case against Robinhood, in which the investors call for a ban or severe limitations on Robinhood. While initially warm to the idea on Capitol Hill, Gensler gave no signal of his support for a ban on Robinhood in the report.

Some, like Tyler Gellasch, executive director of the Healthy Markets Association, believe that the report is even more reason for reforms, saying, “But it is obviously a heavily negotiated document. It was never going to break new ground.”

While Robinhood has already conceded some features, like the confetti that appears after certain milestones, it will be interesting to see whether the reform that many are calling for actually happens.